Cloud computing is the delivery of computing services, including storage, processing, networking, software, analytics, and intelligence, over the internet (the cloud). It allows users to access and use these services on a pay-as-you-go basis, rather than having to invest in and maintain expensive in-house infrastructure.

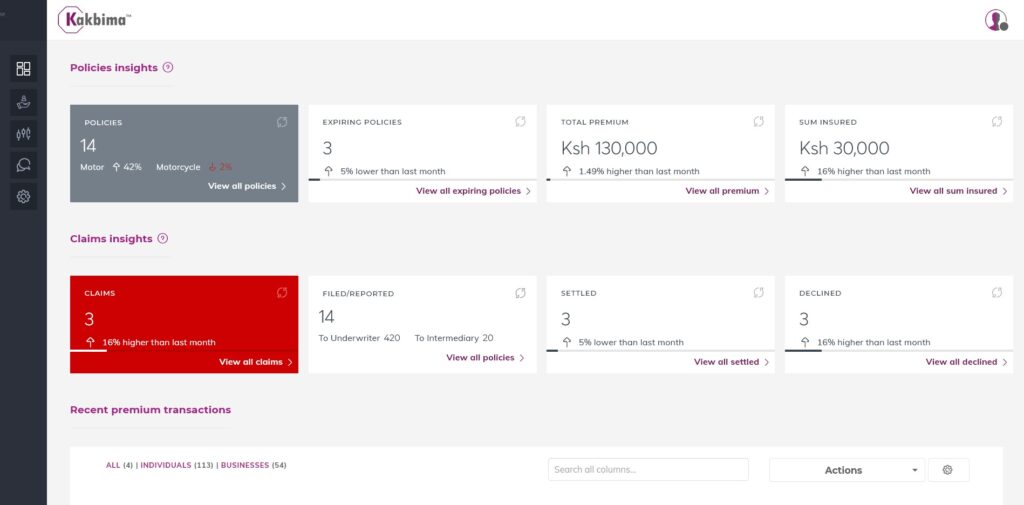

With the Kakbima insurance platform insurers can store and analyze large volumes of policyholder data, including demographics, claims history, and health information. The platform includes advanced analytics and artificial intelligence tools that allow the insurer to more effectively assess the risk of insuring an individual or group.

The insurer may use the platform to identify trends and patterns in the data that suggest certain policyholders are more likely to file claims. The insurer can then use this information to adjust its underwriting and pricing practices, and to develop targeted risk reduction strategies, such as offering incentives for policyholders to adopt healthier lifestyles or better driving patterns.

By using the cloud to store and analyze data, the insurer can more easily access and use the data to inform its risk management decisions. This can help the insurer better understand and manage its risk exposure, improve its underwriting and pricing practices, and ultimately increase its profitability.

Insurance risk management is the process of identifying, analyzing, and mitigating the risks faced by an insurer. It involves understanding the various types of risks that an insurer may encounter, such as financial, operational, and legal risks, and implementing strategies to minimize or eliminate these risks. An instance of risk management in action would be a car insurance company using advanced analytics to assess the risk of insuring a particular driver. They may consider factors such as the driver’s age, driving history, location, and type of car to determine the likelihood of a claim being filed and the potential cost of that claim. Based on this assessment, the company may decide to offer a higher or lower premium to the driver.

Effective insurance risk management involves a number of key activities, including:

- Risk assessment: This involves identifying the potential risks that an insurer may face, and evaluating their likelihood and impact.

- Risk control: This involves implementing measures to minimize or eliminate identified risks, such as establishing policies and procedures, implementing risk management software, and purchasing reinsurance.

- Risk financing: This involves deciding how to pay for potential losses, such as through self-insurance, insurance premiums, or other financing methods.

- Risk communication: This involves informing stakeholders about the risks faced by the insurer and the measures taken to mitigate them.

Insurance risk management is critical for the long-term success and sustainability of an insurer. By identifying and managing risks effectively, insurers can minimize the impact of potential losses, protect their financial stability, and maintain the trust of their policyholders.

Kakbima’s cloud computing has the potential to transform insurance risk management in several ways:

Improved data management and analysis: Insurance companies generate and store large amounts of data, including policyholder information, claims data, and market trends. By storing this data in the cloud, insurers can more easily access, process, and analyze it using advanced analytics and artificial intelligence (AI) tools. This can help them better understand and assess risk, improve underwriting and pricing, and identify new opportunities.

Enhanced collaboration and communication: With future integration with other cloud-based tools such as Google Drive and Microsoft Teams, we’ll be able to allow insurers to share and collaborate on documents, presentations, and other materials in real-time, regardless of location. This can improve communication and collaboration within the organization and with external partners, such as brokers and reinsurers.

Increased agility and scalability: Kakbima’s cloud computing allows insurers to quickly and easily scale their operations up or down as needed, without having to invest in additional hardware or infrastructure. This can help them respond more quickly to changes in demand or market conditions.

Reduced costs: By using Kakbima services, insurers can avoid the upfront costs and ongoing maintenance expenses associated with in-house infrastructure. This can help them reduce operating costs and increase profitability.

Enhanced security: Cloud service providers invest heavily in security measures to protect their customers’ data. This can help insurers ensure the confidentiality and integrity of their sensitive data, as well as meet regulatory requirements. In conclusion, Kakbima has the potential to significantly improve insurance risk management by enabling insurers to more effectively access, analyze, and use data, enhance collaboration and communication, increase agility and scalability, reduce costs, and improve security. As such, it is likely to play a major role in the growth of the insurance industry.

In conclusion, Kakbima has the potential to significantly improve insurance risk management by enabling insurers to more effectively access, analyze, and use data, enhance collaboration and communication, increase agility and scalability, reduce costs, and improve security. As such, it is likely to play a major role in the growth of the insurance industry.