As the insurance industry grows, insurance intermediaries and producers are finding it increasingly complex to sell older insurance products. Products that are five plus years old with the same coverages, limits of liability, clauses, excesses and the same target audience have become prohibitive to growth, and an impediment to entering new markets. In our previous post on what to expect for our birthday month 2021 this month, we promised to reflect more on this and how it affects new feature launches like quotation and automated calculation of premiums for your customers. We have a few changes and improvements to better this.

Before building the Motor and Motorcycle products setup, we surveyed and spoke to a number of Kakbima users and industry veterans about how they handle product configurations for their businesses. Their responses underscored their urgency, frustration, and desire for a “flexible way to build, configure and provide customer centric insurance products for their customers”. In our survey, we found that roughly one in five users were selling insurance products as is — better known as off shelf products. Of those who provide custom products 46% of them found it difficult to track and keep up with the policies sold under these products, 32% turned to a third party to try navigate these challenges off course at a significant expense and 22% simply accepted the problem and learnt to live with it.

Providing on demand insurance products or becoming a customer centric insurance provider can get so complicated that it becomes nearly impossible for smaller businesses to handle alone. Insurance is a regulated industry and to operate businesses must understand the regulatory rules for different regions that they sell/operate into —or face paying penalties and interest. Moreover, product regulations and rates aren’t rules you can set and forget, in Kenya the Insurance Regulatory Authority (IRA) gets to approve any new products before they’re sold. Slight adjustments on the coverages, limits of liability, clauses, and excesses that differs from the original product will also need approval from the IRA.

At Kakbima, additional enhancements and changes on the product setup functionality have been brought upon to provide a more customized approach when setting up a product and help businesses manage the complexity of providing custom insurance products to their customers. This post lifts the hood on the Kakbima insurance platform products setup module. For insurance agents, brokers, microinsurers, insurers, insurance enthusiasts, and curious readers alike, we want to share how our products setup works, and how it’s geared towards solving a few problems for users:

- Separately setting up product coverages, limits of liability, clauses, and excesses

- Providing regional or location-based product configuration options

- Defining a product from the different configurations to speed up the quotation and policy creation process.

- Setting up commissions for your agents and brokers as an insurer or micro-insurer and vice versa.

Hopefully you’ll find it useful if you run an insurance business or just like geeking out about insurance products (we can relate)

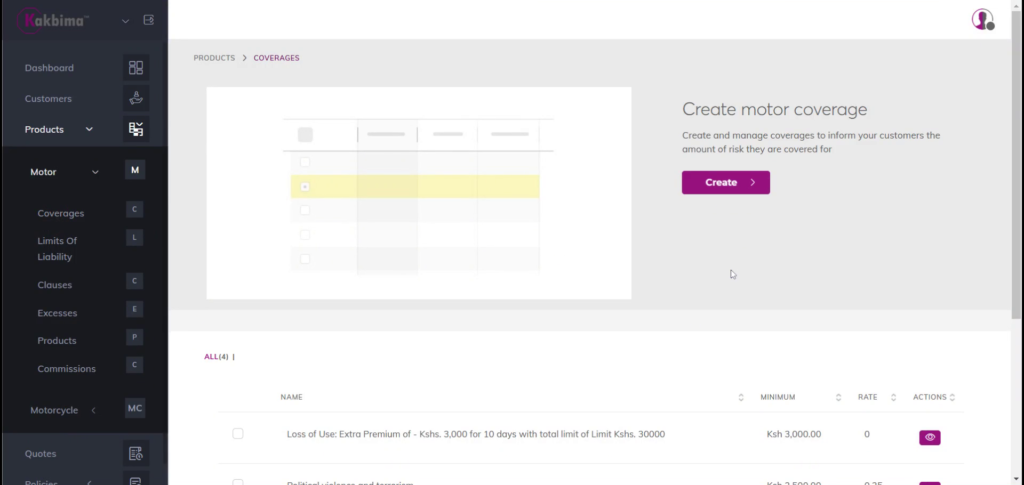

Separately setting up product coverages, limits of liability, clauses, and excesses

This is what largely builds the policy document issued to your customers. When setting up a product, the first step is to provide the different nuances that build up that product. You get to inform your customers the amount of risk they are covered for, the maximum amount you are liable to when the risk manifests itself, the risks assumed by the insurer, and how much they will contribute towards a claim in case of an accident.

Consider a scenario where you’d want to offer insurance products to customers from specific geographical areas with different coverages or clauses. In Kenya, there are no restrictions from the regulator on the number of clauses, coverages, excesses and limits of liability one can offer their customers as long as they are operating within the realm of the initial product approved. This kind of product offering is manageable in the short run but as the business grows managing this becomes a problem, it is either the insurance business chooses to focus on keeping track of the already existing policyholders or bring in new business.

To make these variances in customer centric products offering manageable for users, we provide a simplified setup process that captures this. This is a one-time process that an intermediary or producer user goes through. Our goal is to help producers and intermediaries provide explicit rules that are to govern a product without losing any accuracy in product premium calculation.

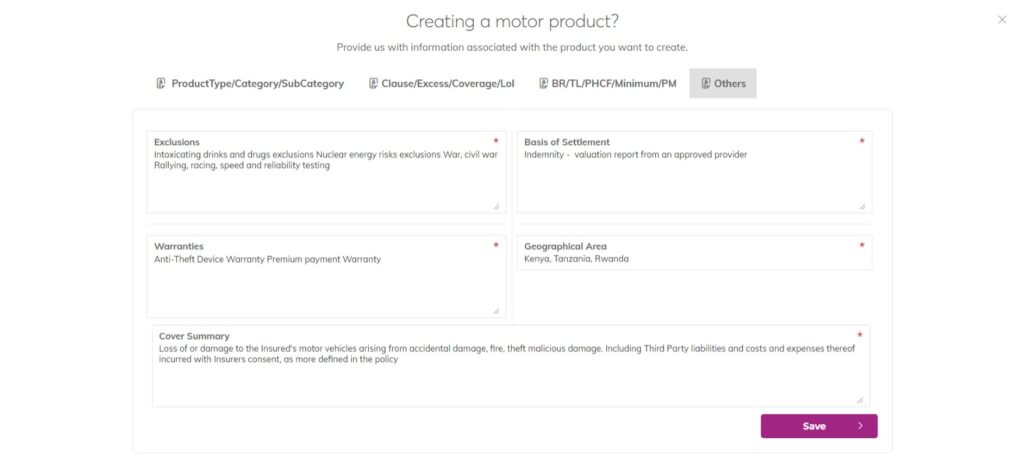

Providing regional or location-based products configuration options

Location, location, and location. Once a business accurately sets up the rules that govern the insurance contract, it needs to be able to offer the product to whatever jurisdiction it so wishes as long as it has been approved by the regulator. In the physical world, Insurance agents, brokers and insurance company sales representatives have a simpler way of dealing with this; don’t sell the product outside the restricted areas! Online, the rules are more complicated and the desire for precision about the customer’s location becomes valuable information.

To help users tackle location-based product offering, we had to abstract away the location problem. This requires not just address cleansing, but answering a few questions:

- What location information can be used? We can use explicit information and some implicit location information, depending on the region. Explicit information is data that a customer types out, such as their country, county/province/state, city/town, and address. Implicit location information is data we can infer from a customer, such as an IP address or the payment method.

- What information is needed to inform accurate location determination? The required information for address resolution depends on the product offered. For example, some insurance companies offer products at the country level, but others would want to stretch this further and offer the product on a town-level accuracy given the different livelihood experiences by their customers in these different towns.

- What information is sufficient? Once we determine the information that we can use and that is useful to our users, we need to decide the information that we should use—and in which sequence—to determine a customer’s location. In some cases, we might be forced to store multiple pieces of nonconflicting evidence.

With these questions we sought to answer with legal research, data analysis, and engineering efforts. With our origins as an insurance platform provider, we knew we could use information that individuals and businesses provide to Kakbima to provide exact products during quotation and policy creation, instead of having producers and intermediaries ask the customers to extract, understand, and apply this information themselves and then buy a product. This approach means that enabling reginal or location-based products setup is as simple as defining the countries, cities or towns through which the product is offered.

Defining a product from the different configurations to speed up the quotation and policy creation process.

Once a business accurately determines its customers’ locations, it needs to create the specific insurance product it wishes to offer. This process is much simpler as it tends to combine all the information above with a few additions of different tax rate that are to be paid for the product.

At this point a simple picking and dropping of the initially added product clauses, coverages, excesses and limits of liability allows the user quickly configure a market ready product with accuracy. This product will then be used during automated quotation generation and customer policy creation.

Setting up commissions for your agents and brokers as an insurer or micro-insurer and vice versa.

This is a very new feature in our product setup journey with a simple aim of allowing agents and brokers know how much they have made from the products’ sale. The same information is relayed back to the insurers and micro-insurers where they get to see their agents’ and brokers’ performance. Our current offering is a simple addition of commissions based on the different products offered.

What’s next

Just as customer needs differ from one region to another, so does insurance offerings. We want to demystify and automate this burden so businesses can focus on growing and providing more customer centric products. Removing this friction for businesses is in lockstep with our mission of helping build a better insurance. Today, our product setup features bring about high accurate and customer centric product setup options with scalable and reliable infrastructure that our largest enterprise customers can rely on, with the ease-of-use, flexibility, and simplicity. Looking ahead, we plan to build more on Kakbima’s product setup and quotation management modules that are fully standalone options that offers features —from advanced product setup to automated quotation provision to producer and intermediary customers with a full product purchase process, enabling end-to-end automation. We will continue to work towards this goal.