In the world of insurance, a profound paradox persists: customers yearn for the lowest premiums while simultaneously desiring exceptional service. This quandary I have observed sparks a reflection on the intricate dynamics between cost and quality within the insurance sector.

The essence of the conundrum lies in the dichotomy of customer expectations. On one hand, individuals acknowledge the statement “you get what you pay for,” yet, in the world of insurance, the sentiment often appears inverted. Why does the thought to be obvious knowledge about the correlation between cost and quality seem to elude the insurance industry?

Last week I was engaged in a conversation with Tilie, the owner of a partner insurance brokerage firm on this complex issue. We were more focused on drawing attention to the misalignment between perceived value and the intangible nature of insurance. The discussion begun with my observation that many customers view insurance as a form of financial responsibility, akin to a living will. It’s something essential, but often neglected until it becomes urgently relevant. This comparison underscores the challenge the industry faces in communicating the value of insurance to customers who may never experience a major claim and accused him of being part of the problem; not communicating the value of insurance to hist existing policyholders well enough.

Of course this narrative has been enriched by anecdotes and experiences shared by existing, previous and potential policyholders who have been part of our consumer awareness research program(Bimwik). One responded emphasizes the importance of understanding insurance as a financing mechanism for controlling the costs associated with financial responsibility. However, the statistic that fewer than one-fifth of his colleagues ever use the insurance product contributes to the perception that it is a futile expense for the majority.

According Tilie there is a disconnect between perceived value and the actual service experience. He shares stories of customers who, having never filed a claim, question the necessity of their insurance expenditures. He then goes further and revisits the analogy of a living will, highlighting that people often recognize the importance of risk management only when it becomes pertinent to their lives.

Our conversation then shifts to the impact of customer choices on service quality. When a customer opts for the lowest rate there is a higher likelihood they will experience subpar service when a claim is filed. This off course raises a fundamental question: does the pursuit of the cheapest rates inevitably lead to a compromise in service quality?

Tilie then mentions Chubb; the world’s largest publicly traded P&C insurance company and the leading commercial lines insurer in the U.S, and states that he considers it to be a reputable insurance provider that has introduced the concept of premium pricing aligned with superior service. While I acknowledge the unaffordability of policies from such distinguished companies, there is a consensus that the quality of service is commensurate with the cost. This prompts further consideration of the trade-offs between affordability and service excellence in the insurance landscape.

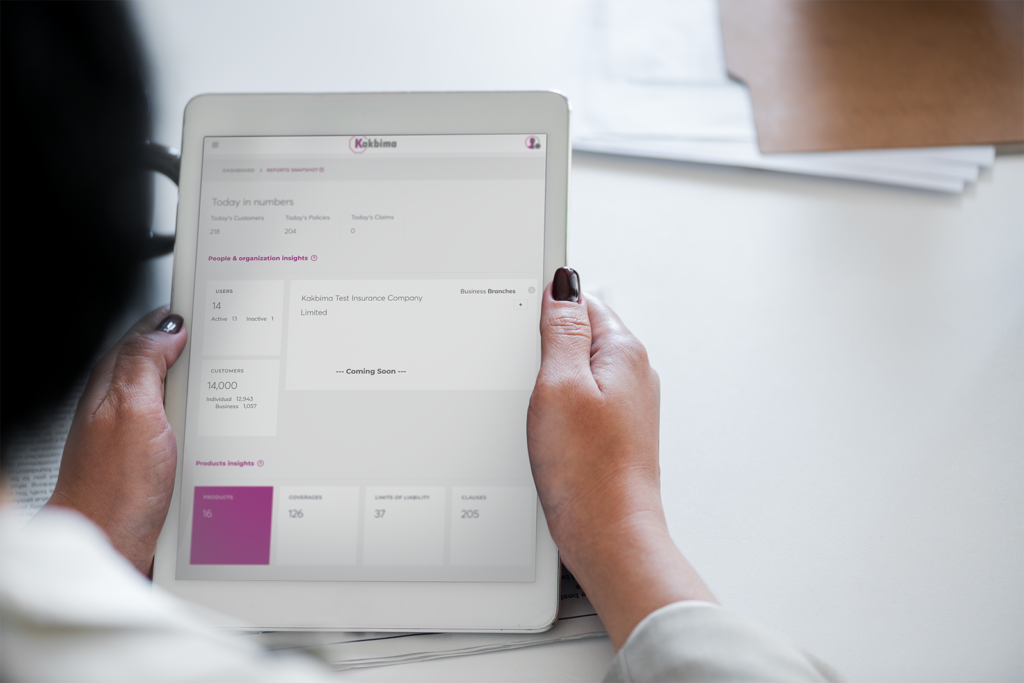

Our experience at Kakbima has taught us that there is a lack of customer awareness regarding claims service, policyholders may not fully grasp what constitutes good service until they experience it firsthand. This lack of interaction with insurance companies can be looked at as a barrier to understanding the nuances of service quality, as well as a reason for customers’ focus on price rather than coverage.

The role of coverage selection in shaping perceptions of insurance value

Some customers may perceive insurance as a waste of money due to inadequate coverage choices, leading to dissatisfaction when claims are filed. This suggests that an informed understanding of coverage options is crucial for customers to derive value from their insurance investments.

From a customer’s perspective, the challenge lies in the absence of a reliable means to gauge the quality of service before a claim occurs. Majority participants of our consumer awareness research program showed a desire to have a trustworthy third-party entity compile and present statistics on claims and after sales service done by existing industry players. Our observations were that existing rating systems, deemed unhelpful and biased, leave customers seeking a more transparent and unbiased assessment of insurance providers.

Some respondents saw the need for region-specific ratings, as service quality can vary widely depending on the geographic location. Anecdotes from those working in the industry highlight the subjective nature of customer satisfaction, emphasizing that experiences with insurance companies can be highly dependent on individual circumstances.

It is paramount to note that most countries have insurance regulatory bodies that regulate companies and maintain complaint systems. Some of these departments often publish complaint statistics for each insurance company, offering consumers insights into the company’s performance and customer satisfaction. The big question at this point is can we solely rely on these publications?

It is fair to point out that insurance professionals face numerous challenges, particularly in claims handling. Stories of customers demanding the lowest rates and later seeking compensation for inadequate coverage highlight the delicate balancing act that insurance providers must perform to meet customer expectations while safeguarding their own interests.

Tilie and I concluded our conversation with a reflection on the perennial nature of the dilemma. Customers, it seems, will always be torn between the desire for cheap rates and the expectation of world-class service. The insurance industry faces the ongoing challenge of communicating the intangible value of its services and dispelling the notion that insurance is a mere financial burden until a crisis unfolds. In contemplating potential solutions, our discussion was hintting at the role of technology in automating processes and improving customer service. The quest for a technological solution to streamline insurance operations and enhance the overall customer experience to reflect the evolving landscape of the industry. I can confidently say that Kakbima is well positioned to make this a reality.