Price comparison platforms, automated claims processing, customer relationship management – these are just some of the best customer centric digital services that insurance customers expect and insurers want to provide. As the demand for digital insurance skyrockets, so does the need for insurers to invest in IT. This is a clear indication that technology is no longer a cost center but rather an asset that if managed well can increase growth and profitability.

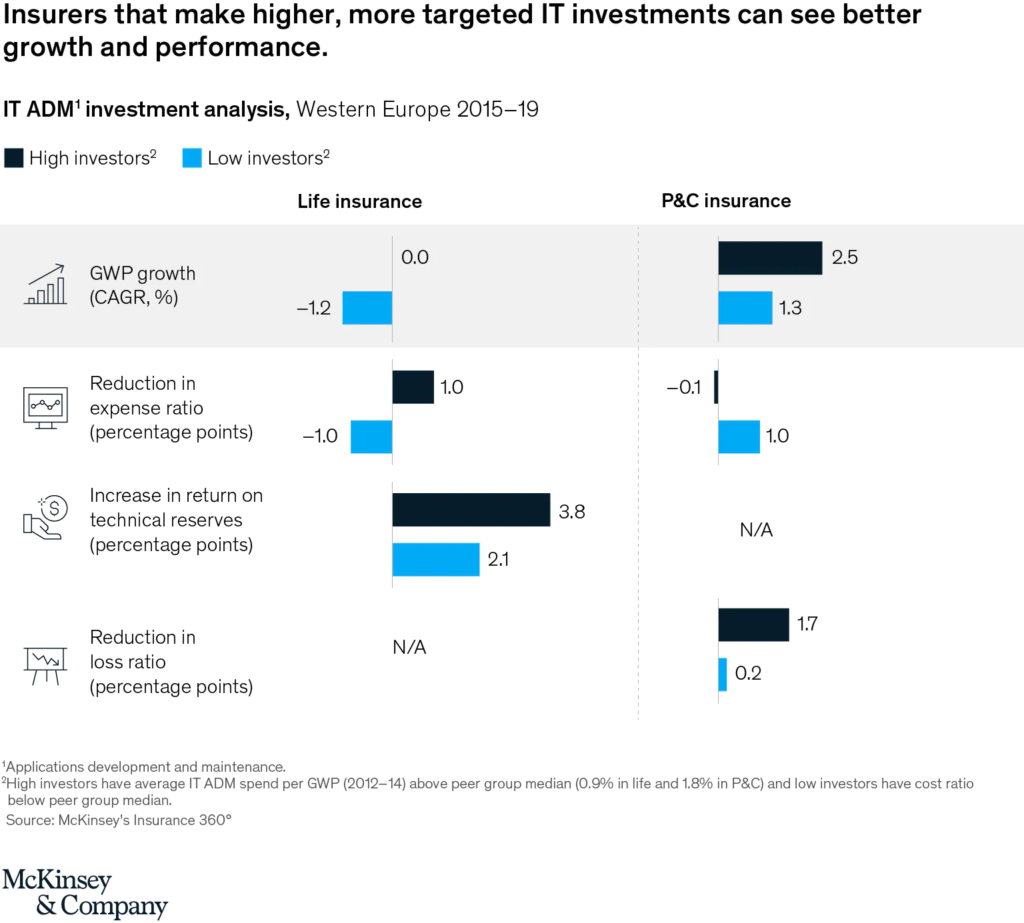

Data from McKinsey’s Insurance 360° benchmarking survey provides strong evidence of the positive business impact of targeted technology investments. In fact, insurers that invest more in technology outpace competitors that don’t pursue targeted investments in business measures such as gross written premium (GWP) growth, return to shareholders, and expense and loss ratio (exhibit).

As an example, in life insurance, companies that invested more in IT saw a greater reduction in expense ratios (by 2.0 percentage points) and higher returns on technical reserves2 (1.7 percentage points) when compared with insurers with lower IT investments. Insurers achieved these outcomes within three to five years of making their investments.

For P&C insurers, those with high IT investments achieved approximately twice the top-line GWP growth of low IT investors. High IT investments also produced a greater reduction in combined ratios when compared with those with low IT investment.

There are a number of different types of technology investments that insurers can make in order to achieve growth and improve productivity and performance. Some examples of these investments include:

Data analytics and artificial intelligence (AI): Investments in data analytics and AI can help insurers to better understand customer needs and preferences, identify trends and patterns, and make more informed decisions about underwriting and risk management. This can help insurers to achieve growth by increasing the efficiency of their operations and improving customer satisfaction.

Cloud computing: Cloud computing can help insurers to reduce their IT costs and improve the scalability of their operations. By moving to the cloud, insurers can take advantage of economies of scale and pay only for the resources they use, rather than investing in expensive hardware and software.

Digital platforms: Insurers can invest in digital platforms such as websites, mobile apps, and online portals to improve customer engagement and make it easier for customers to access and manage their insurance policies. This can help insurers to improve customer satisfaction and loyalty, as well as reduce the cost of servicing customers.

Robotic process automation (RPA): Insurers can invest in RPA technologies to automate routine and repetitive tasks, freeing up human workers to focus on higher-value activities. This can help insurers to improve productivity and efficiency, as well as reduce the risk of errors and mistakes.

Internet of Things (IoT) technologies: Insurers can invest in IoT technologies to gather data from connected devices and use that data to improve underwriting and risk assessment, as well as to identify opportunities for cost savings and efficiency improvements.

Blockchain: Insurers can invest in blockchain technologies to improve the efficiency and security of their operations, as well as to explore new business models and market opportunities.

Advanced analytics and predictive modeling: Insurers can invest in advanced analytics and predictive modeling tools to improve their ability to analyze and understand large amounts of data, and to make more informed decisions about underwriting, risk assessment, and other key business activities.

Cybersecurity technologies: Insurers can invest in cybersecurity technologies to protect against data breaches and other cyber threats, and to ensure the security and confidentiality of customer data.

Advanced automation and machine learning tools: Insurers can invest in advanced automation and machine learning tools to improve the efficiency and accuracy of their operations, and to identify opportunities for cost savings and efficiency improvements.

Customer relationship management (CRM) systems: Insurers can invest in CRM systems to improve their ability to manage customer relationships, track customer interactions, and deliver personalized experiences

It is important for insurers to carefully evaluate their business needs and goals, as well as the potential ROI of different technology investments, in order to identify the investments that will be most beneficial for their organization.