It’s been well over 36 months, 4 prototypes, one MVP and The platform… here we are, still going strong with our zeal to make a change within the insurance industry. I thought it would be nice to share some updates about our growth (product development), our partnerships, our squad structure, and some things that still aren’t adding up, like our long-complicated road of not making a profit!

The gist of things

In the last six months we had embarked on a complete rewrite of our platform, closed a small financing round led by The Baobab Network, completely rewired our squad structure, reshaped our marketing strategy, launched the continent’s first insurance graphql API (Alpha), and shipped more than 253 platform changes to production.

I thought writing something on our success and pitfalls might be a good thing, or is it?

Startup entrepreneurial life hardly lets you take a moment to reflect on the good, the bad and the ugly moments, so when it does happen, it’s a real treat. I especially love the facts that often come up while doing the background research.

The long-complicated road of not making a profit

As a crucial part of the business highly propelled by the revenue generation model for our SaaS platform, we’ve been working with the belief that a good revenue model is a proven technique used by digital businesses globally, from startups to global corporations, to generate income from traffic on their website, mobile apps, and via digital channels.

We have made lots of models, some in test while others being demoed to our potential customers. Why is this the case? Well we thought we had it all figured out after our prototypes with the agents and brokers. Things are different with micro-insurance and insurance companies, we wouldn’t want to abruptly cancel already existing membership programs for our current users and later come back around like an ex promising you they’ve changed.

We’ve been working on different revenue generation models, to support policyholders, agents, brokers, micro-insurers, insurers and re-insurers which will help fund and create insurance awareness.

The good news is, for the first time; thanks to our business development team’s (2 person squad) hard work, we’ve reached the point where we have enough data to take action and bring something to our users. Fixing our losses requires fine tuning the machine, tweaking our product, pricing, and paying users, but we’re already seeing encouraging results.

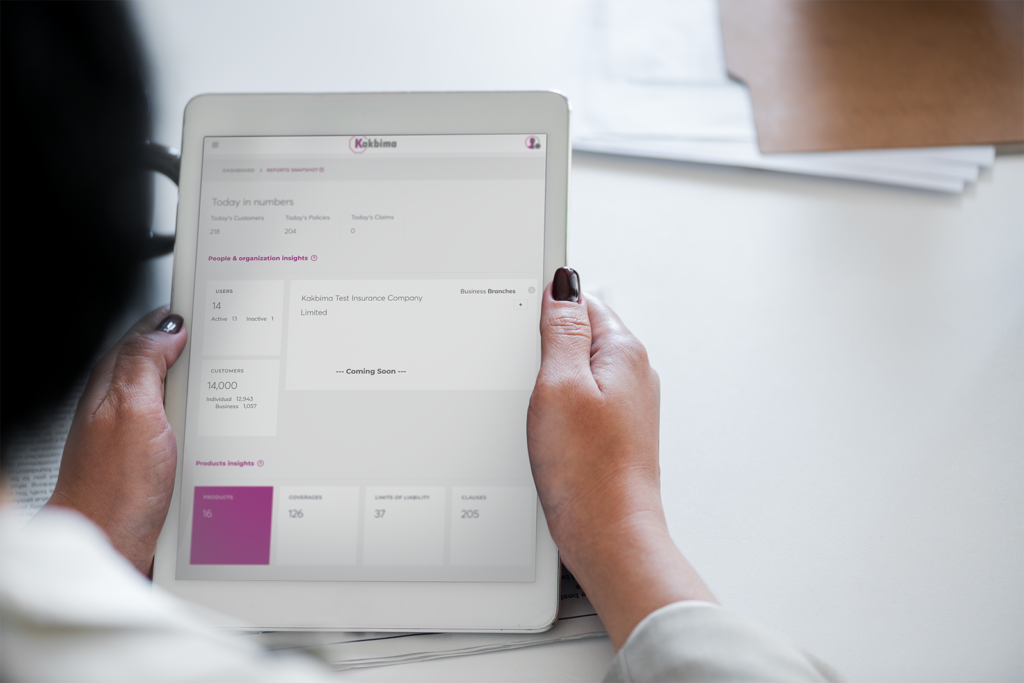

Rewriting the platform

A number of our existing intermediary and producer users continue to handle their underwriting and claims via paperwork, only using the platform for tasks that their internal systems can’t handle.

Unlike our platform which can scale to infinity and beyond, with more policyholders means the human team (intermediaries and producers) are struggling to keep up. Despite the fact that we received very few complaints from the heads of different departments, we should have done a better job of system integrations. Allowing the claims department collaborate effortlessly with the underwriting department while working on different systems.

Instead of focusing on having our customers learn to use a completely new platform while still in love with the old one despite its’ pitfalls, we decided to shift our focus to customer happiness. But that’s easier said than done. Eventually, we were required to do a complete rebuild of our platform. Lots of improvements, changes here and there and more importantly our customers/users will be able to run two systems at the same time. Watch out on this space this coming month.

The squad restructures

About 10 years ago, the ‘squads’ concept came to life.

Originally introduced by Spotify, squads were the new way to organize development teams as autonomous groups of cross-disciplinary people, working together towards a common goal with little to no bottlenecks along the way.

We’ve come to love the squads structure and use them to the extreme, spiking them with our own special sauce. We’re a small team and thanks to COVID-19 the team has grown more resilient led by myself, I work closely with the business development team, as well as backend, and frontend engineers; occasionally churning code as often as I can.

With a smaller team, it means to be efficient we need to solve scalability challenges with lines of code rather than manual labor.

Alright, that’s it for now! Back to work. More stories to come.